The information contained herein is of the general nature and isn't meant to handle the situation of any individual particular person or entity. Although we endeavor to deliver precise and timely details, there is often no warranty that these types of information and facts is precise as on the date it can be obtained or that it will go on to generally be exact Later on.

This contains modelling in the implications of demographic tendencies and government coverage on homes, and governing administration profits and expenditure.

"We can have a lot more to state about pricing and price savings for users when that approach is accomplished," the spokesperson explained.

Remember that even When you've got a lot of assets once you retire to be eligible for that pension, take into account that as you attract down on the superannuation (which is taken into account an asset), you may most likely turn out to be eligible for the age pension as your stability decreases.

Non-concessional contributions are following-tax amounts that you choose to include for your super that you've previously paid out tax on. being eligible for making just after-tax contributions, you need to have much less

"discussions about accessibility should be happening – insurers and resources should question, rather than assume a technological innovation illiterate or know-how-lousy consumer will self recognize."

really should your projected complete superannuation equilibrium exceed the projected Transfer stability Cap (see down below) at any calendar year from the projection, your projected non-concessional contributions is going to be limited to zero for that 12 months.

Every fund normally has a distinct identify for this option. Ours is called the Lifecycle Investment method. Do I must open an account with my employer’s super fund? really, you are able to typically choose your personal fund.

"Your number of default deal with drops as you receive to sixty and past. So, at the time if you're a lot more very likely to need to have to say with your insurance policy, you are purchasing a Significantly reduced-worth products."

If you do not have up to you need, start out getting steps to create up your Tremendous to spice up your retirement savings.

Super resources are transferred into the retirement period when a member starts a brilliant money stream (or pension).

Your economic problem is exclusive and the services and products we review might not be proper for click here your personal instances. Forbes Advisor encourages visitors to hunt unbiased professional information from an authorised money adviser in relation to their particular financial conditions and investments before you make any financial decisions.

C – Single asset course products and solutions are removed from assortment and only diversified solutions are viewed as

A different bugbear of Keating as well as crossbench is Labor’s software of the extra taxes to “unrealised gains”.

Mr. T Then & Now!

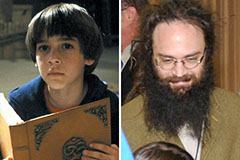

Mr. T Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! David Faustino Then & Now!

David Faustino Then & Now!